MELANIE GESY NEWS

Canada’s Govt and Income Taxes - A 100 Year Love Story

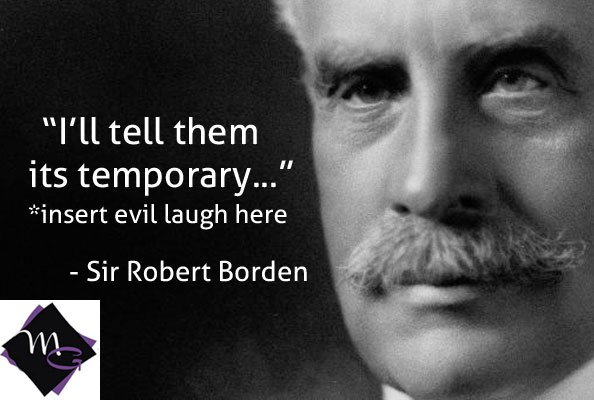

(or; How “Temporary” Means “Over a Century” in Canada)

1917 was quite a year in Canadian history. It was the year of the Great Halifax Explosion, which many historians now admit wasn't even as great as, say, The Great Depression. As well, 1917 was the year Canadian troops captured the village of Passchendale in the Third Battle of Ypres, which eventually led to a domestic feature film about Canadian actor Paul Gross' grandpa. (SPOLIER ALERT: The army guys inevitably had to give the town back to the Passchendalites.) As many bitter Canucks are reminded every spring, however, 1917 was also the year the federal government introduced Income Tax to our country.

Just how long is "temporary" supposed to last?

Numerous Canadian comedians, both professional and those retaining their amateur status, often make sport of the fact Canada's original income tax system was designed be a temporary measure. It was to be repealed when the fairly short-lived First World War (aka WWI) failed to be renewed for the new season. Unfortunately the sequel, WWII, followed so quickly, there wasn't time to get rid of the tax before it was needed again for the new war effort. Since then, however, it has grown in popularity with elected officials of every ruling party, who become addicted to the cash and think up numerous plans of spending it but zero plans of ending it.

From these small beginnings...

Originally, Canadian Income Tax legislation was a fairly simple document with minimal impact, and consisted of just ten pages, unlike the modern 3000 page behemoth. The Bill didn't actually apply to very many people, though; only single men making over $2000 and married men earning upwards of $3000 were eligible. Given the average annual salary for a Canadian manufacturing job at the time was a whopping $1315, the tax affected less than 5% of the population. The highest tax bracket, for those raking in the big bucks, ($6000) was 25%. Even as late as 1934, the temporary tax still only affected about 199,000 people or less than 2% of the ten million strong national total.

The Demilitarized Zone

Canada officially removed the whole "war" angle of income tax in 1948 after WWII came to a close and couldn't be used as an excuse to commandeer a portion of a person's paycheque anymore. The name of the Bill was altered to reflect this change, from "The War Tax Act" to "The Income Tax Act" which ensured the continuance of the windfall, even in peace time when expenses are considerably smaller. By this time, the legislative Bill had doubled in size to twenty pages and included ten different brackets from 15% to 84% (84%!?!?!) with around 17% of the population being forced to file a return.

The Never-Ending Story

A major tax overhaul, begun in 1962, was eventually enacted as legislation in 1971 (the wheels of government do turn slowly, don't they?) which included a record 14 tax brackets and a maximum tax of 61.34%. By that year, the tax was being applied to 37% of the population. The number of brackets was slashed to just three in 1996 but 2010 saw an addition of one new bracket. By this time, about half the population was eligible to pay the tax. It may soon be the case, however, with our province working towards a $15 minimum wage, the percentage paying taxes will grow even more. The only thing we know for sure about this tax is that it may have once been temporary; it's not going anywhere, anytime soon.